Top 5 Accounting Software Choices for Small and Medium-Sized Businesses

4 min read

Managing finances is an essential part of any successful business, whether you are directly responsible for monitoring the money or not. This is especially true for small to medium-sized enterprises. You might be required to file your expense report or manage invoices from contractors and vendors. Or, you may have a more significant role in the accounting department or as a business owner. Whatever your role may be, having reliable accounting software is vital for keeping things organized and streamlined. With so many options available, choosing the right accounting software can be challenging. This article provides five solid choices for small to medium-sized businesses to help you make an informed decision.

1. Intuit QuickBooks

When you think of the term “accounting software,” QuickBooks is likely one of the first to pop into your mind. And for good reason – QuickBooks has so many features and tools that will help you stay on top of your accounting and invoicing.

For small to medium-sized businesses, QuickBooks offers a range of plans suitable for everyone from self-employed individuals to large enterprises. Its features include tracking income and expenses, running payroll, and generating insightful reports to help you monitor your company’s financial performance.

One of the standout features of QuickBooks is its user-friendly interface. While the software is feature-rich, it is not overly complicated or cluttered, making it easy to navigate. Users can quickly find the information they need without any confusion. With the mobile app and QuickBooks online, the software can be accessed from anywhere, not just on desktop computers.

Price: Small business plans begin at $24 per month.

2. Xero

Xero is another popular accounting option for many businesses. It offers many of the same features as QuickBooks and places a high value on mobility and accessibility – meaning you can download the Xero app for both iOS and Android.

Xero provides standard accounting software functions, reports, and tools that you would expect to manage your business. One of the significant benefits of Xero is that it offers multi-user access to your account at no additional cost, which is useful for multiple people, including accountants and employees, who need to work on the software.

However, compared to QuickBooks, Xero has a smaller pool of advisors available to help you since it is not as well-established. This factor is important to consider, particularly if you need a lot of assistance getting started. Xero has more affordable starting plans than QuickBooks, but you need to pay extra for additional features such as payroll. Xero offers a 30-day free trial to evaluate the software.

Price: Plans begin at $9 per month.

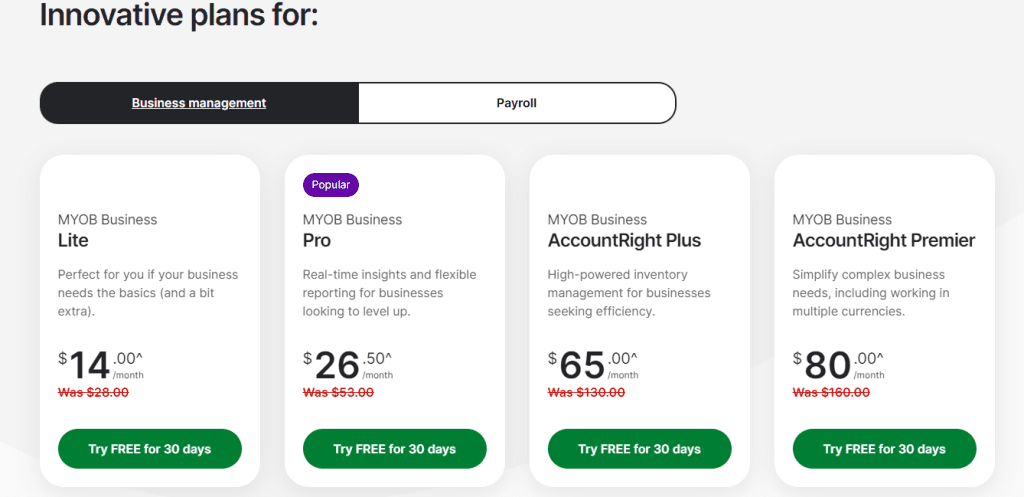

3. MYOB

MYOB (which cleverly stands for “Mind Your Own Business”) is a solution that you might not be as familiar with. Based in Australia, it’s another viable accounting option for many small to medium-sized businesses, particularly those who also operate out of Australia.

MYOB is an accounting software that provides features to ensure tax compliance with the Australian Taxation Office, making it a popular choice for businesses in Australia. However, MYOB also offers a range of features for businesses outside of Australia, such as the ability to link bank accounts, send invoices, and manage contacts from your phone. MYOB plans are reasonably priced, and the AccountRight level plan even allows you to manage two businesses from one account.

Price: Plans begin at $14 per month.

4. FreshBooks

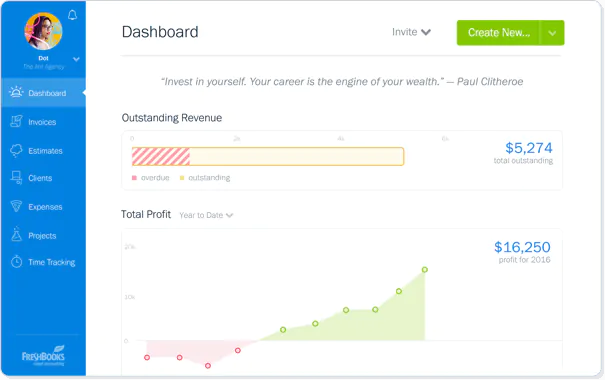

One thing that makes FreshBooks stand out is the fact that it lives in the cloud (regardless of which plan level you choose!) – meaning you can access your information conveniently and securely from anywhere that you are.

FreshBooks offers a range of features that can help you simplify your accounting tasks and save time. For example, you can set up automatic payment reminders and late fees to keep your payments on track. You can also track when your clients have viewed an invoice, eliminating any worry that it may have been lost in the shuffle.

FreshBooks offers several plan options, allowing you to choose the one that best meets your needs and budget. This flexibility, combined with FreshBooks’ time-saving features, makes it a great choice for small and medium-sized businesses looking to streamline their accounting processes.

Price: Plans begin at $15 per month.

5. Wave

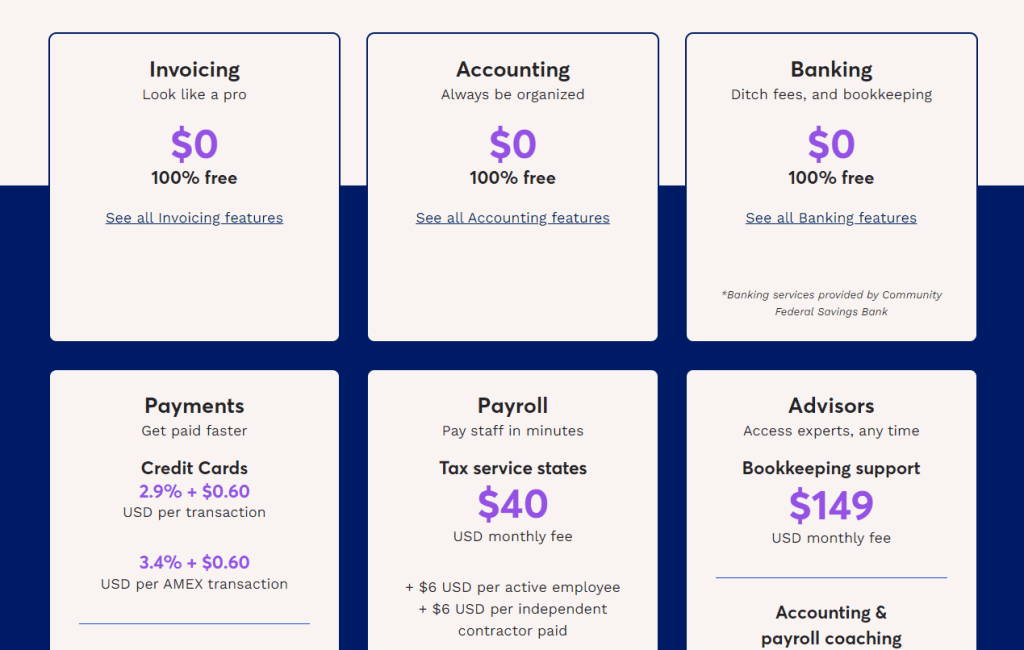

While Wave is best known by freelancers and independent contractors, the platform does offer functionality for small businesses and startups who have fewer than 10 employees.

Wave’s user-friendly interface is a major selling point for many users. The software is designed to be accessible to non-accountants, so you won’t be bogged down by complicated features or jargon.

Wave makes it easy to access the most important information, such as your cash balance and invoice status, without being overwhelmed by unnecessary tools and features.

Another major benefit of Wave is that it’s completely free. However, some features like payroll will require a fee.

All in all, Wave is a great solution to get started. But, if you’re aiming to grow at a rapid pace, you might want to opt for a slightly more expensive and comprehensive accounting software that can grow along with you.

Price: Free!

Conclusion

There are numerous accounting software options available for small and medium-sized businesses. With the information provided, you can weigh your options and select the best tool for your team. If you’re seeking customer reviews to help inform your decision, be sure to check out G2’s compilation of the top accounting software.